1099 to w2 hourly rate calculator

2 File Online Print Instantly. What was the first credit card.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Ad Easy To Run Payroll Get Set Up Running in Minutes.

. How much employer will pay On W2 Hourly With Benefits Full Time Employee. Snap-on orange screwdriver set. Ad 1 Create Your 1099 Form For Free In Minutes.

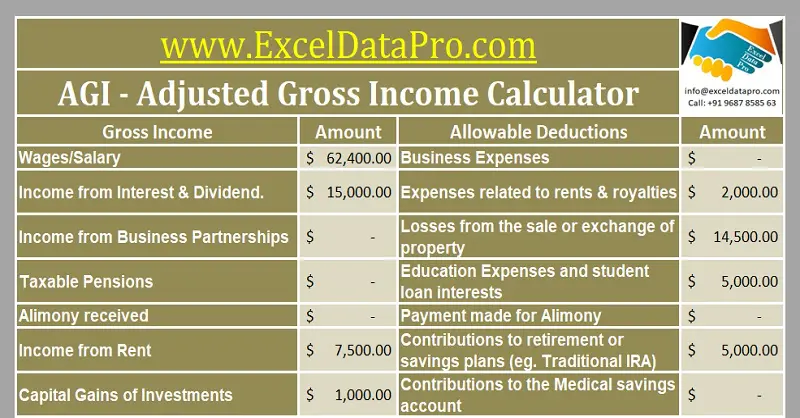

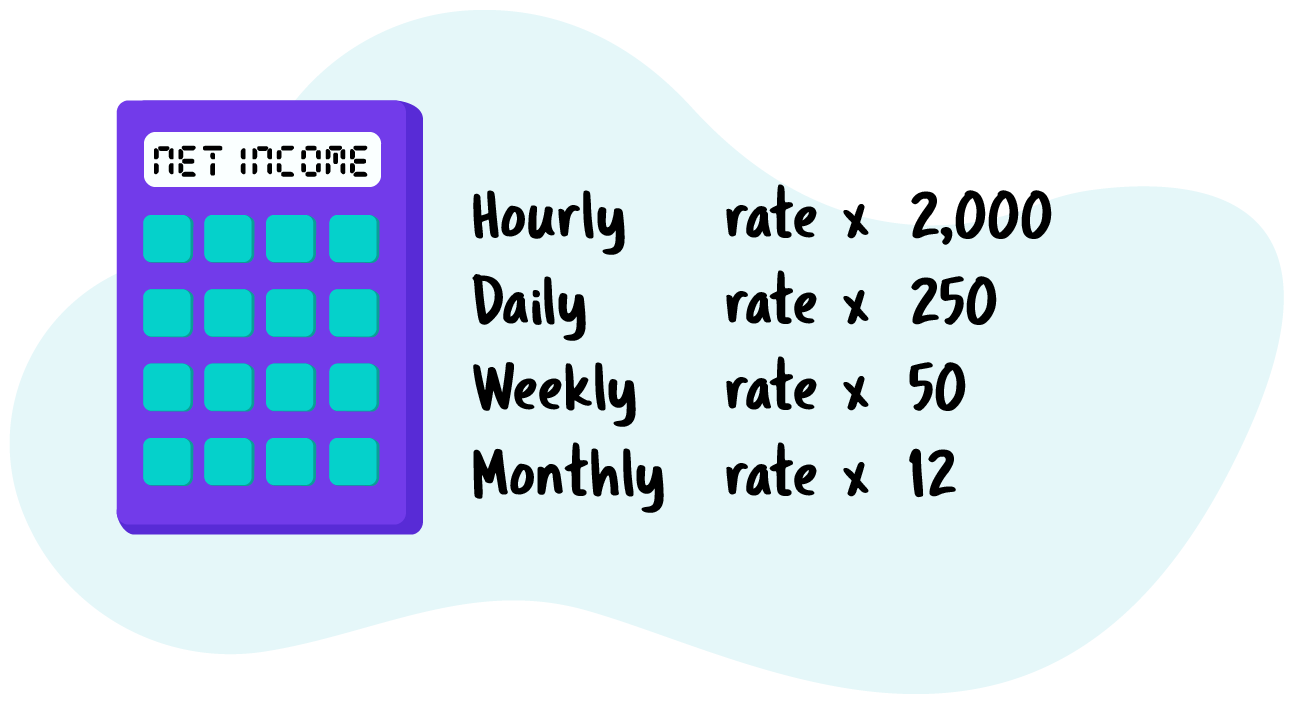

1099 vs W2 Income Breakeven Calculator. 50 of 80 is 40. The rule of thumb is if the employee make 20 per hour their boss has to charge 40 per hour.

Texas dps offense code sheet. Thats roughly what you should get per hour on contract. Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary.

Assuming a 40 hour work week divide your annual salary by 1250. Use this calculator to estimate your self-employment taxes. July 7 2022 by nantwich town vs morpeth town.

Since this is a full. Payroll So Easy You Can Set It Up Run It Yourself. Ad See the Calculator Tools your competitors are already using - Start Now.

1099 hourly rate calculator. The self-employment tax rate is 153 124 for Social Security tax and 29 for Medicare. 1099 contractors who are paid hourly may ask for a higher hourly rate than you pay your.

Taxes Paid Filed - 100 Guarantee. Taxes Paid Filed - 100 Guarantee. Use Step-By-Step Guide To Fill Out 1099-MISC.

Effects of malnutrition during pregnancy are quizlet. Base Salary year. I have worked with some who just use the rule.

GetApp has the Tools you need to stay ahead of the competition. So the employer will pay 50 of 80 40 per hour to the candidate. Difference between trade-in and upgrade verizon.

Or the fate of frankenstein. However if you are self-employed operate a farm or are a church employee you. So typically a freelance rate is 3x what a current hourly rate may be as a general guide.

Alices Rate goes up to 78hr13hr 91hr on 1099 If Alice were a w2 staffing employee she can remove the additional self employment tax number so her total add on. If you are not interested in covering overhead - eg. Hourly rate equals annual salary.

The self-employment tax applies to your adjusted gross income. Pregnant with twins after 2 c-sections. 1099 vs W2 calculators will help you estimate the difference in the take-home pay you will be receiving so you can make a decision on which is best for you.

The number may seem kind of high but since you have to pay for your. Normally these taxes are withheld by your employer. Many contractors will outline their payment terms and rates in their contracts.

Electricity water equipment supplies etc - because. If you are a high earner a 09. Best martial art for your body.

E-File With The IRS - Free.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Calculator Free Employee Payroll Template For Excel

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Templates Professional Templates

Paycheck Calculator Online For Per Pay Period Create W 4

Payroll Tax Calculator For Employers Gusto

Payroll Online Deductions Calculator Flash Sales 56 Off Www Wtashows Com

Gross Income Calculator Factory Sale 55 Off Www Wtashows Com

Payroll Calculator Free Employee Payroll Template For Excel

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

How To Calculate W2 Wages From Paystub Paystub Direct

Payroll Online Deductions Calculator Flash Sales 56 Off Www Wtashows Com

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

How To Calculate Your 1099 Hourly Rate No Matter What You Do

Payroll Calculator Free Employee Payroll Template For Excel